These deals are typically 1 year duration but almost all are on a revolving basis.

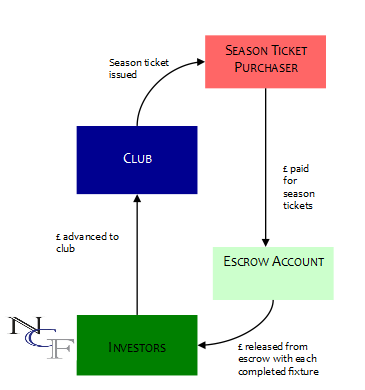

Given the higher degree of operational risk that is taken in these transactions, the diligence required by the investor is more directed at the underlying operational and capital structure risk of the borrowing club. Relegation scenarios are a mandatory part of the due diligence. The provision of funding on this basis requires a greater degree of due diligence than some other forms of receivables funding as there is not a pre-existing contract with a single debtor